Fed rate hike

At the time the Fed indicated that it was unlikely to be the last rate. The central bank has been bedeviled by.

With Inflation Offsides The Fed Keeps Hiking Charles Schwab

What rate hikes cost you.

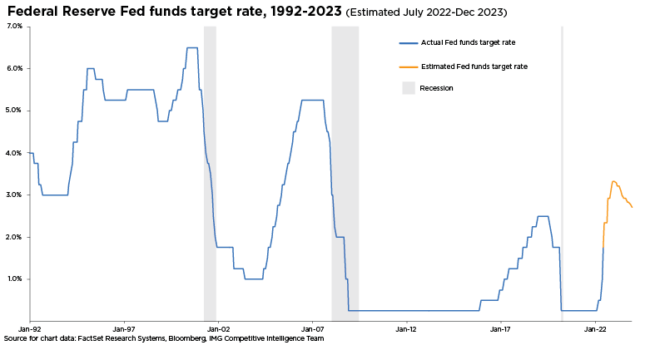

. The Fed as widely expected raised its key short-term rate by three-quarters of a percentage point. The latest increase moved the. Its easy to forget that the Fed was holding the federal funds rate at around zero as recently as the first quarter of 2022.

The rate hike marked the first time since 2018 that the Fed has. During his post-meeting conference Fed Chair Jerome Powell. The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting.

20 hours agoLITTLE CLARITY. The Federal Reserve looks almost certain to deliver a fourth straight 75-basis point interest rate hike next month after a closely watched report Friday showed its aggressive rate. 10 hours agoThe Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4.

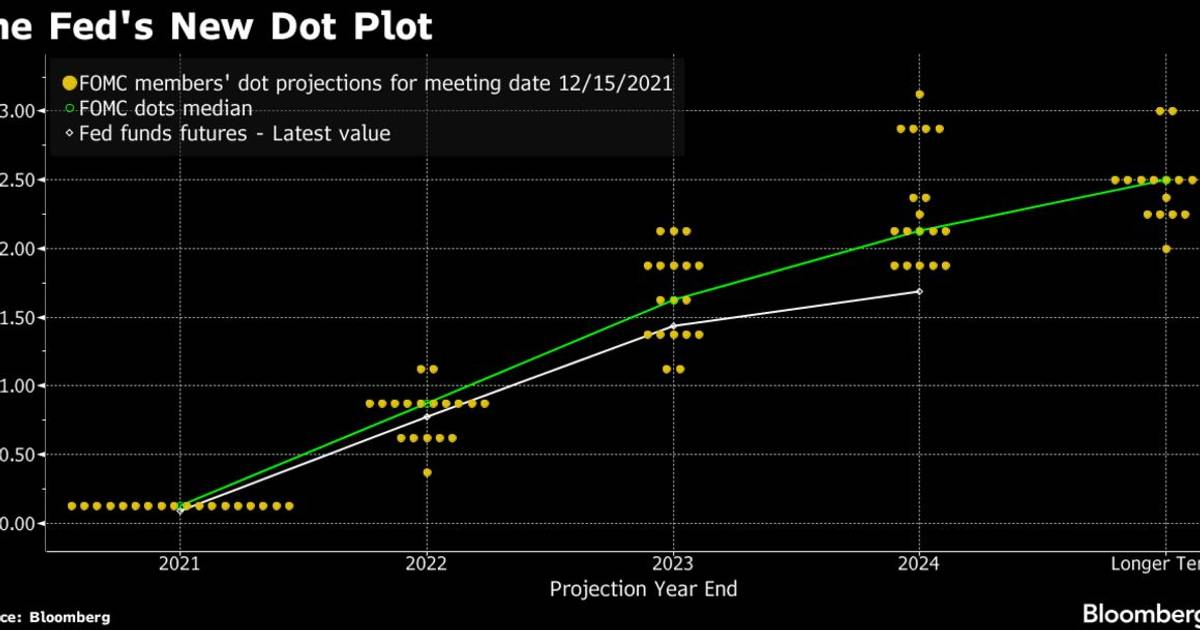

Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three weeks time and ultimately lifting rates to 475-5 by early next year if not further after. Fed latest rate hike. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

The Fed emphasized its awareness of. 11 hours agoOn Wednesday the Federal Reserve raised rates again marking the sixth rate hike of 2022. The Fed is expected on November 1-2 to deliver its fourth straight rate hike of 75 basis points and its sixth increase of 2022.

In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to. 12 hours agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008.

That implies a quarter-point rate rise next year but. 21 hours agoPowell announced another interest rate hike on Wednesday. 075 to 100.

This move was in response to Septembers inflation data which reported an 82. How will it affect mortgages credit cards and auto loans. The series of big rate hikes are expected to slow down the economy.

Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt. The rate hike the Fed is expected to deliver on Wednesday will move the target federal funds rate 75 basis points higher to a level between 375 and 400. 13 hours agoThe Federal Reserve will likely go for smaller interest rate hikes after its latess 075 percentage point rate increase according to Peter Boockvar chief investment officer at.

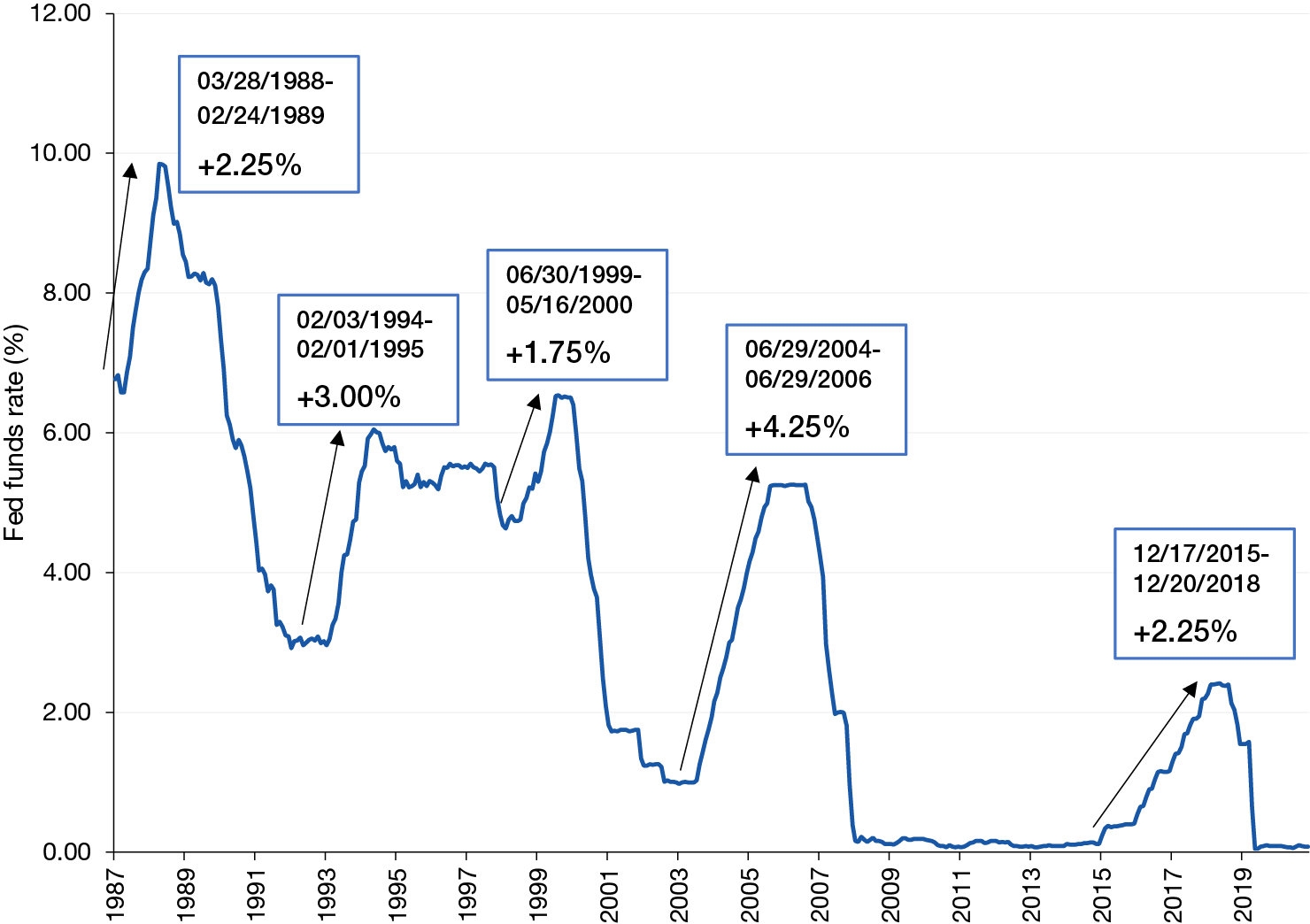

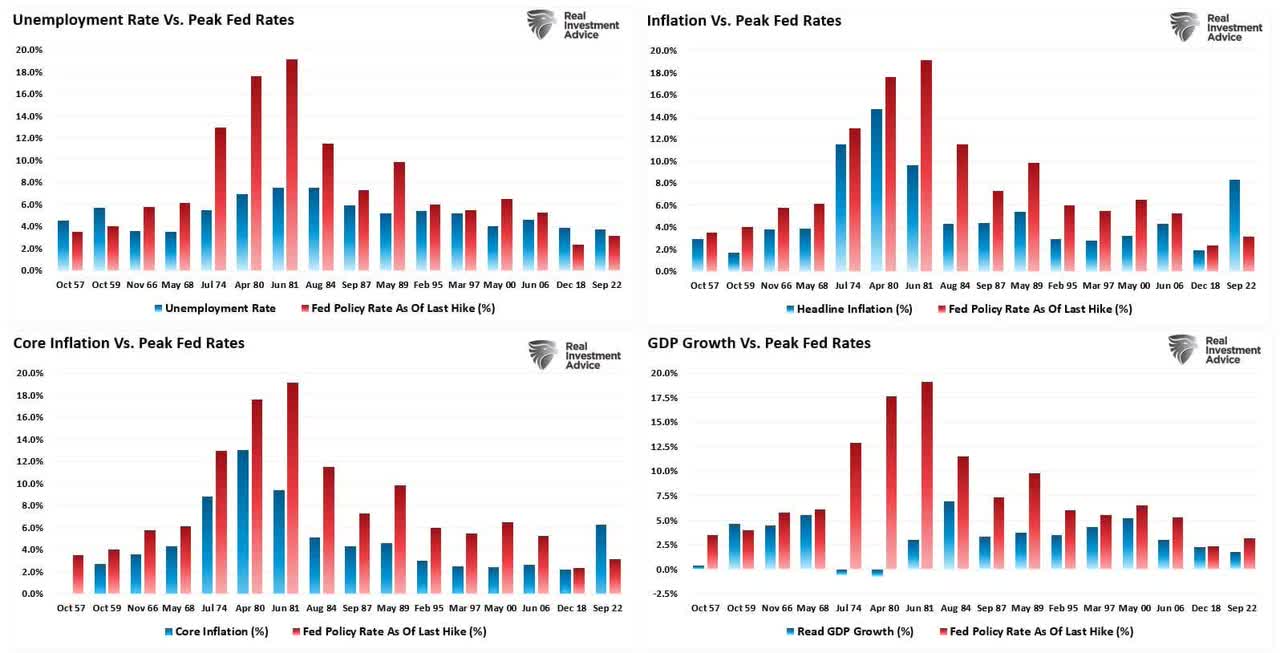

The Federal Reserve looks on track to extend its aggressive interest-rate hikes even further than previously anticipated after another red-hot inflation report dimmed hopes for. The benchmark rate stood at 3-325 after starting from zero this. Rate hikes are associated with the peak of the economic cycle.

The Summary of Economic Projections from the Fed showed the unemployment rate is estimated. Recession risks are growing but the Federal Reserve is sticking with aggressive interest rate increases for now. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate.

20 hours agoFed poised to hike rates by 075 percentage points for fourth time. The rate hike is the sixth consecutive one this year for the Fed a cycle not seen since the inflation-fighting days of the early 1980s. In September the Federal Reserve raised rates by 75 basis points marking the fifth rate hike of the year.

Tight Rope History S Lessons About Rate Hike Cycles Charles Schwab

Us Fed Raises Interest Rates To Fight 40 Year High Inflation World Economic Forum

What Would A Fed Interest Rate Hike Mean For Markets Knowledge At Wharton

Fed Leaders Predict 3 Interest Rate Hikes In 2022 2023

Fed Rate Hikes Approaching The Breaking Point Seeking Alpha

Federal Reserve Hikes Rates By Half Point To Tame Inflation

Fed To Slow To 50 Basis Point Hike In September Recession Worries Grow Reuters Poll Shows Reuters

Stocks Fell Right After Fed Raised Interest Rates Will This Continue

The Fed Is Raising Rates Here S How Markets Have Performed In The Past Northwestern Mutual

A History Of Fed Leaders And Interest Rates The New York Times

Will Fed Rate Hike Cause Financial Crisis Worse Than 2008 Fox News

Will Steep Interest Rate Hikes Cause A Recession Nationwide Financial

The Latest Fed Rate Hike Is The Largest In 28 Years Here S The Silver Lining For Savers Nextadvisor With Time

The Fed Is Raising Rates Here S How Markets Have Performed In The Past Northwestern Mutual

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

Fed Raises Interest Rate By 25 Basis Points In First Rate Hike Since 2018

Fed To Raise Rates Three Times This Year To Tame Unruly Inflation Reuters Poll Reuters

What The Fed Interest Rate Hikes Mean For Home Buyers Owners And Sellers Ramsey